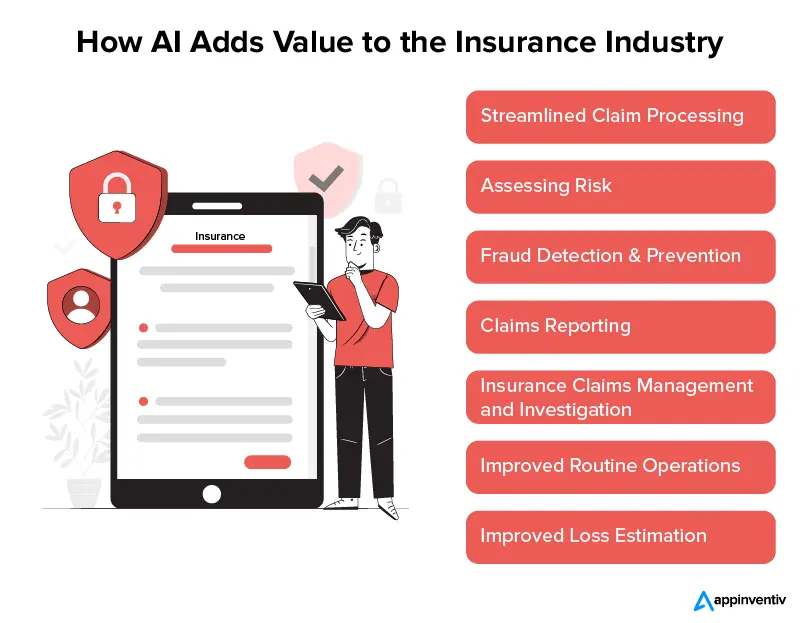

AI Could Transform Health Insurance : For decades, health insurance in India has primarily been reactive, focusing on covering treatment costs after employees fall ill. Employers and insurers have historically absorbed the rising premiums without actively engaging in preventive healthcare. However, the advent of artificial intelligence (AI) is beginning to challenge this approach, enabling proactive health management, early risk detection, and more sustainable insurance models.

With healthcare costs steadily increasing, companies are looking for solutions that reduce long-term expenses while improving employee well-being. AI-driven platforms are now making it possible to identify health risks before they escalate into major medical events, shifting the focus from treatment to prevention. This transformation is likely to reshape the Indian health insurance landscape over the next decade.

AI in Early Risk Detection

One of the most impactful applications of AI in health insurance is early risk detection. Startups like Plum, a health insurance and employee benefits platform, are leveraging AI to analyze over 200 biomarkers to detect early signs of chronic conditions such as diabetes, heart disease, and hypertension.

Plum’s AI assistant interprets complex medical data, flags potential risks, and provides personalized preventive recommendations. This proactive approach allows employees to manage health risks before they become serious, reducing the likelihood of expensive claims and improving overall workforce health.

Read about: Canara HSBC Life Insurance Share Price: Stock Lists at Par with IPO Issue Price on NSE, BSE

Benefits of AI-Powered Health Insurance

1. Reduced Premiums Through Prevention

By catching diseases early, insurers can lower claim costs, which may translate into reduced premiums for employers and employees. This proactive model benefits all stakeholders: healthier employees, cost savings for employers, and lower risk exposure for insurers.

2. Personalized Health Plans

AI allows insurers to tailor health plans to individual risk profiles, considering lifestyle, medical history, and genetic predispositions. Personalized plans can include preventive screenings, wellness programs, and targeted interventions, rather than generic coverage.

3. Enhanced Employee Engagement

AI-driven tools engage employees in their own health journeys. Notifications, reminders, and AI-guided insights encourage healthy behaviors, such as improved diet, regular exercise, and timely medical check-ups. This engagement not only improves wellness but also fosters loyalty and productivity.

4. Data-Driven Decision Making

AI systems aggregate and analyze large volumes of health data in real-time. Insurers can detect emerging trends, forecast healthcare costs, and design more effective policies. Employers can use these insights to improve workplace health programs and reduce absenteeism.

Challenges and Considerations

While AI holds immense promise, there are key challenges in adopting it for health insurance in India:

- Data Privacy and Security: Sensitive health data must be securely managed to prevent breaches.

- Regulatory Compliance: Insurers must comply with evolving regulations, including the Insurance Regulatory and Development Authority of India (IRDAI) guidelines.

- Employee Trust: Adoption depends on employees trusting AI recommendations and sharing personal health data.

- Integration with Existing Systems: Incorporating AI into legacy insurance frameworks requires careful planning and investment.

Future Outlook

The integration of AI in health insurance is expected to accelerate, with trends including:

- Predictive Analytics: Insurers will increasingly predict claims and health events before they occur.

- Wearable Integration: Devices like fitness trackers will feed real-time health data into AI systems.

- Dynamic Premiums: Premiums may become more risk-adjusted based on real-time health metrics.

- Preventive Ecosystems: Comprehensive wellness programs, guided by AI insights, will become standard.

As India’s workforce becomes more health-conscious and tech-savvy, AI-powered preventive healthcare is likely to redefine the employee benefits landscape, making insurance more sustainable, personalized, and outcome-focused.

Conclusion

AI has the potential to revolutionize health insurance in India by shifting the model from reactive care to preventive health management. Early risk detection, personalized health plans, and data-driven insights enable insurers to reduce costs while improving employee well-being.

By integrating AI, companies like Plum are demonstrating that insurance can be more than financial coverage—it can be a comprehensive health management tool. As adoption grows, employees, employers, and insurers all stand to benefit from lower premiums, healthier workforces, and more efficient healthcare delivery.

While challenges remain, including data privacy and regulatory compliance, the long-term benefits of AI integration in health insurance are undeniable. India is poised for a future where AI-driven insights empower employees to proactively manage their health, making insurance both smarter and more impactful.

Also read: HP Omen 16 Max Gaming Laptop: High-Performance Gaming Redefined

FAQs of AI Could Transform Health Insurance

1. How is AI used in health insurance in India?

AI is used to analyze medical data, predict health risks, and recommend preventive measures. It helps insurers manage costs, design personalized health plans, and engage employees in proactive wellness.

2. What are the benefits of AI for employees?

Employees gain early detection of chronic conditions, personalized preventive guidance, and support to maintain a healthy lifestyle, reducing the likelihood of serious health issues.

3. Can AI reduce health insurance premiums?

Yes. By preventing serious health events and lowering claim costs, insurers can offer more affordable premiums to both employers and employees.

4. What challenges exist in adopting AI for health insurance?

Key challenges include data privacy and security concerns, regulatory compliance, employee trust, and integration with existing insurance systems.

5. What does the future hold for AI in health insurance?

The future includes predictive analytics, wearable integration, risk-adjusted dynamic premiums, and comprehensive preventive health ecosystems, making insurance more proactive and personalized.

3 thoughts on “How AI Could Transform Health Insurance in India”