MPCI Insurance in 2026: As global agriculture faces mounting climate volatility, market uncertainty, and evolving regulatory environments, Multi-Peril Crop Insurance (MPCI) continues to stand as the backbone of agricultural risk mitigation in 2026. From droughts and floods to pest infestations and disease outbreaks, MPCI provides comprehensive protection that stabilizes farm income and ensures long-term operational sustainability.

In major agricultural markets like the United States, MPCI policies are administered under frameworks supported by the Risk Management Agency (RMA), a division of the United States Department of Agriculture. Similar structured programs are being strengthened globally, reflecting a growing consensus that crop insurance is not optional—it is essential infrastructure for food security.

By 2025–2026, adoption rates have reached record highs in regions heavily exposed to climate variability. Farmers increasingly recognize that unpredictable rainfall, extreme heat events, and shifting pest patterns can erase a season’s revenue without robust insurance coverage. MPCI insurance protects against multiple perils under a single policy—typically including adverse weather, fire, insects, plant disease, and other unavoidable yield-reducing factors.

Why MPCI Remains Indispensable in 2026

Modern agriculture operates on tight margins, high capital investment, and complex supply chains. One severe weather event can jeopardize not just crops but loan repayments, labor commitments, and land leases.

MPCI addresses this by:

- Stabilizing farm income during yield losses

- Protecting against widespread regional disasters

- Supporting access to agricultural financing

- Enabling continuity planning and long-term investment

As climate patterns become less predictable, MPCI policies have evolved to reflect regional risk profiles. Insurers now rely on granular weather modeling and historical yield datasets to price coverage more accurately, making policies both more responsive and financially sustainable.

Top 2026 Trends Shaping Crop Insurance

The crop insurance landscape in 2026 is defined by technological transformation and data-driven precision.

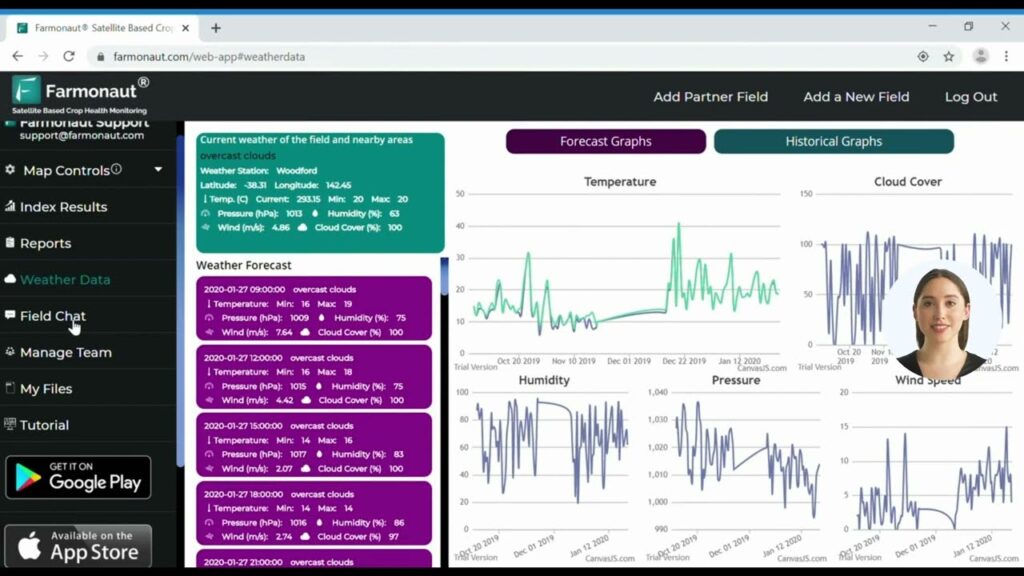

1. Advanced Analytics & Satellite Monitoring

Insurers and agencies now routinely use satellite imagery, remote sensing, and AI-powered predictive modeling. These tools:

- Improve acreage reporting accuracy

- Detect crop stress earlier

- Reduce fraud

- Enable parametric triggers in some policy designs

Satellite-based yield estimation has significantly improved underwriting precision, allowing for more tailored risk assessment.

2. Hyper-Tailored Coverage

Blanket policies are giving way to region-specific and even farm-specific products. Soil health data, historical rainfall variability, irrigation access, and crop diversification patterns are now integrated into policy design.

This personalization enhances fairness in premium pricing while encouraging climate-resilient practices.

3. Digital Customer Experience

Farmers increasingly rely on digital platforms to:

- Compare policy types

- Use crop insurance calculators

- Submit acreage reports

- Track claims in real time

Mobile-first interfaces are particularly impactful in rural regions, reducing dependency on paperwork-heavy processes.

4. Rapid Claims Processing

Drone inspections, IoT soil sensors, and AI-driven damage assessments have dramatically reduced claim settlement times. In many advanced markets, average claim processing has dropped to under 14 days.

Faster payouts help farmers maintain cash flow during critical planting or harvesting windows.

5. Yield Protection Prioritization

Yield protection crop insurance remains a central pillar of MPCI offerings. Given increasing climate unpredictability, farmers are opting for higher coverage levels to secure guaranteed revenue thresholds.

Revenue-based and yield-based policies are being blended in innovative ways to provide more stable financial buffers.

Leading Crop Insurance Agencies in 2026

Several agencies and insurers continue to dominate the MPCI landscape in 2026 due to strong technological integration, customer service, and diversified product portfolios.

- Rural Community Insurance Services (RCIS) – A major private-sector provider known for broad MPCI distribution and technology-driven claims processes.

- ARMtech Insurance Services – Specializes in federal crop insurance programs with strong analytics capabilities.

- ProAg – Recognized for agent-focused service models and regional adaptability.

- Rain and Hail Insurance Service – One of the longest-standing crop insurance providers, emphasizing risk education and advisory support.

These agencies act as intermediaries between government-backed programs and farmers, ensuring regulatory compliance while customizing policies to local agricultural conditions.

The Expanding Role of Crop Insurance Agencies

In today’s ecosystem, agencies do far more than sell policies.

Policy Structuring & Advisory

Agencies analyze farm-specific risk exposures, recommending optimal combinations of:

- MPCI coverage

- Supplemental coverage options

- Revenue protection add-ons

- Rural property insurance

This consultative approach ensures comprehensive protection across crop yields, farm equipment, and infrastructure.

Technology Integration

Agencies now integrate satellite data, weather forecasts, and predictive analytics directly into client dashboards. Farmers receive alerts regarding:

- Emerging weather risks

- Coverage thresholds

- Reporting deadlines

This proactive communication reduces underinsurance risks and improves compliance.

Claims Advocacy

During loss events, agencies assist with documentation, dispute resolution, and coordination with adjusters. In large-scale disasters, this support is essential to ensure fair settlements.

Rural Property Insurance: Complementing MPCI

Beyond crop yields, rural property insurance is increasingly bundled with MPCI. Coverage often includes:

- Barns and storage facilities

- Irrigation systems

- Farm machinery

- Livestock structures

As automation and high-value equipment become standard in modern farming, asset protection is becoming as critical as yield protection.

Read about: Insurance Mis-Selling in India

The Future of MPCI Beyond 2026

Looking ahead, MPCI programs are expected to incorporate:

- Parametric insurance models tied to rainfall or temperature indices

- Blockchain-based claims verification

- Greater integration with carbon credit markets

- Climate-resilience incentives tied to premium discounts

As agriculture transitions toward sustainability and climate adaptation, insurance will remain a central stabilizing force.

Conclusion

MPCI insurance in 2026 stands at the intersection of climate resilience, technological innovation, and financial stability. With rising adoption rates, faster claims processing, and increasingly tailored coverage options, crop insurance has evolved into a sophisticated risk management ecosystem.

For farmers, it provides the confidence to invest in productivity and sustainability. For insurers and agencies, it represents an opportunity to leverage data and innovation to deliver more precise, equitable, and efficient protection.

In an era where agricultural risks are intensifying, MPCI is no longer merely a safety net—it is foundational infrastructure for global food security and rural economic resilience.